We hope you are having a wonderful Summer. We are so grateful that we have been able to open our doors and have in person meetings again with our vaccinated clients.

Have you seen our newly updated website? We invite you to click here and read about our growing team of professionals. We also have a Client Login page which outlines the different platforms we use and includes links to login to Schwab Alliance, eMoney and our Client Portal. Click here to check it out and don't forget to bookmark this page for quick access.

We are excited to announce that Alina has passed the CFP® exam and looks forward to assisting the Beacon team as a paraplanner as she continues towards her CERTIFIED FINANCIAL PLANNER™ designation. Please join us in congratulating Alina Leon!

"Dreams don't work unless we do. I believe in defining my goals and working hard towards them with a positive mindset until they become reality. I am so grateful for all of the support and encouragement from my team of successful women that know how to empower." - Alina Leon

Do you have a 529 Plan for your children or grandchildren? If so, there has been a recent change and distributions from grandparent owned 529 plans no longer affect financial aid eligibility for the students.

Click here to watch Kelli's video with the distribution rule update.

|

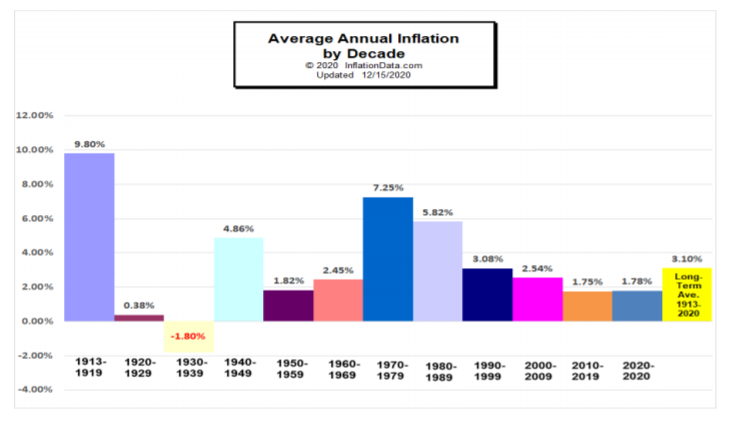

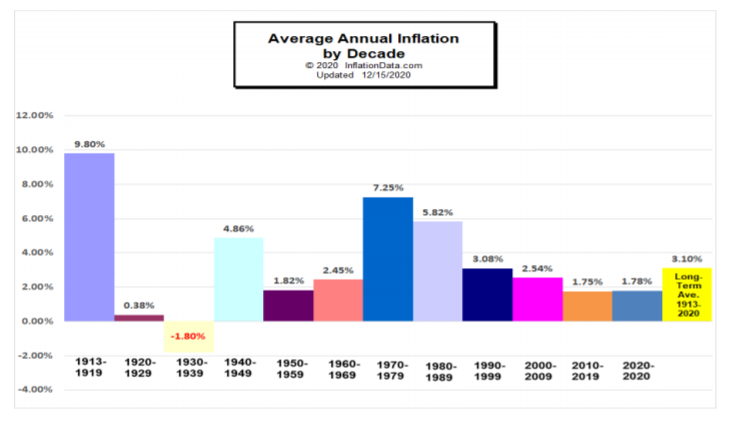

Inflation seems to be the topic on most minds - how could it not be with headlines that read, “US inflation sees highest levels since 2008!” and “Inflation is Surging: How high will it go?”

From May 2020 to May 2021, the inflation rate rose to a whopping 5% - yes, this is a newsworthy number; however, for comparison the inflation rate in May 2020 was only 0.1%. Now, when we take the average inflation rate over the five-month period starting from January 2021 to May 2021, we get 3%. And if we remove food & energy prices (which are highly volatile) and only look at core inflation, that is even more digestible at 2.6%. Drilling down one more level, lets remove used cars from core inflation (due to the simple fact that current supply is not meeting current demand and demand is huge), we are looking at an inflation rate of only 1.9%. Right around the Fed’s target of 2%.

|

|

|

|

We do believe that once supply chains stabilize and the service & manufacturing sectors fill much needed empty jobs, we will see the prices of food, gas and even used cars stabilize. Until then, it is important to remember that our economy and the world’s economy is still very much in recovery mode with most of the EU and developing countries many, many months behind the US. While we do feel this uptick in consumer prices is temporary, it is a good reminder of what to do in periods of higher-than-normal inflation – continue to hold a diversified portfolio. Spreading risk across a variety of different asset classes is a time-honored method of constructing a long-term portfolio that is as applicable to inflation-fighting strategies as it is to asset-growth strategies.

The chart above shows the inflation rate by decade with an overall long-term average of 3.1% from 1913 to 2020.

As always, we are here to talk through any questions or concerns you may have. Thank you for your continued trust.

With gratitude,

Your Team at Beacon Financial Planning

|

|