Why We Can't Simply Jump In & Out of Markets

We first want to thank you for your continued trust. The reason you hired our team is to navigate you through times like we are experiencing now. We are here for you and won't allow you to let emotions drive financial decisions. Our commitment to YOU is to separate emotion from strategy.

Please remember every financial plan we create is stress tested and we plan for times of uncertainty when we speak about your financial goals. You have already pro-actively planned for market volatility and that is why you have a balanced portfolio.

We understand that you may acknowledge and believe everything stated in the above paragraphs, but that does not make this time any easier emotionally- we hear you.

The financial markets don’t like bad news. The current coronavirus outbreak is no exception, and many investors are tempted once more to “do something.” But in times of volatile markets, the best move of all for long-term investors is often no move at all.

While they’re not exact parallels, the stock market responses to the SARS coronavirus in 2003 and the Zika virus in 2016 offer useful lessons. In both cases, investors who sold on bad news and falling prices missed significant rebounds that very shortly had stock markets back to prior levels.

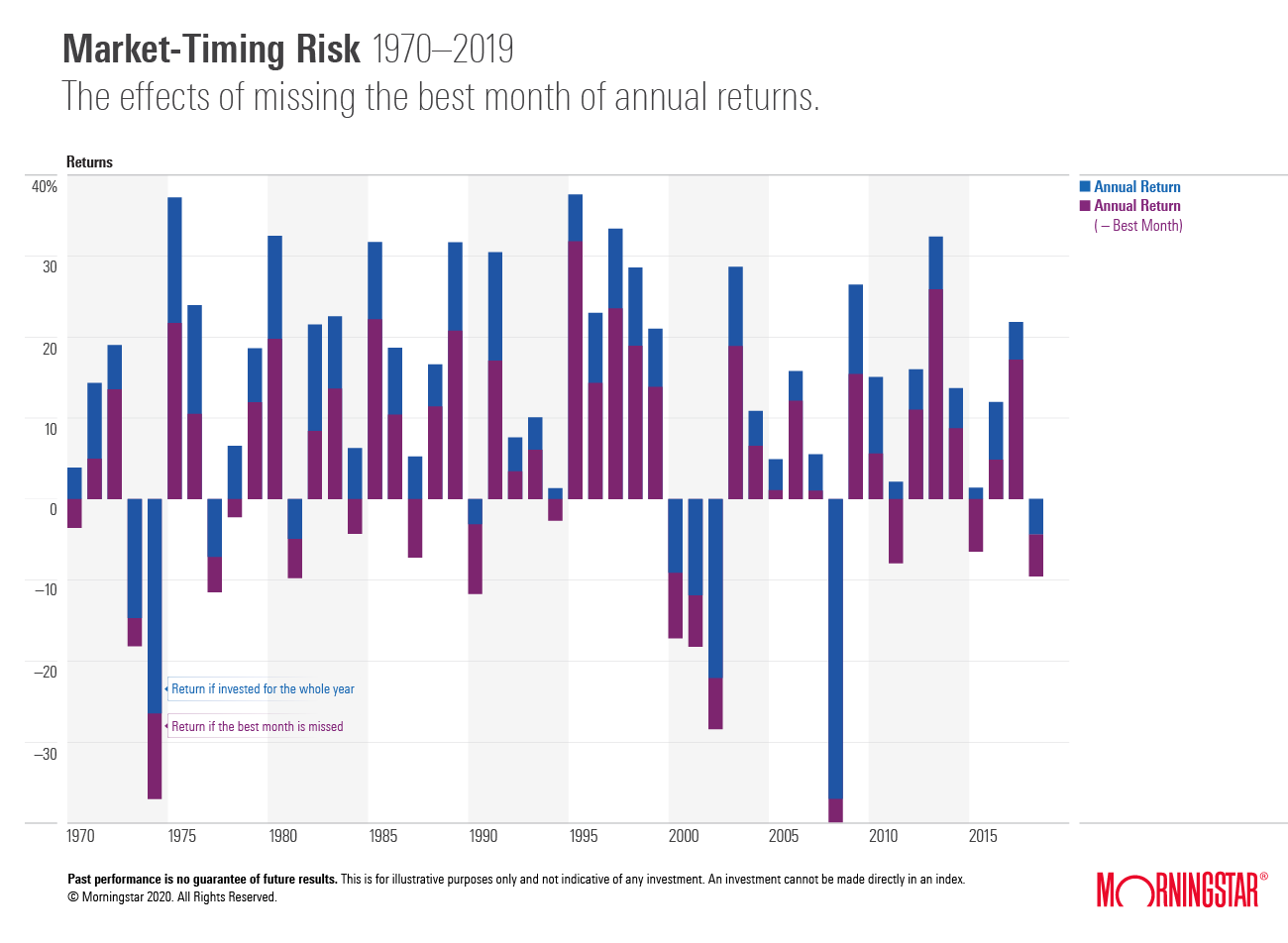

There’s no guarantee that today’s market will play out the same way; stocks have also taken days, months or longer to regain losses. But remember that knowing when to get back in is just as hard as knowing when to get out. The following chart shows the risk of market timing: the effects of missing the best month of annual returns.

The investment strategy we’ve mapped out for you is a long-term plan based on your personal goals and circumstances. For those of you currently taking income from your portfolio, we have planned for this as we pro-actively create cash for your near term needs.